Managing flood risks with your property portfolio

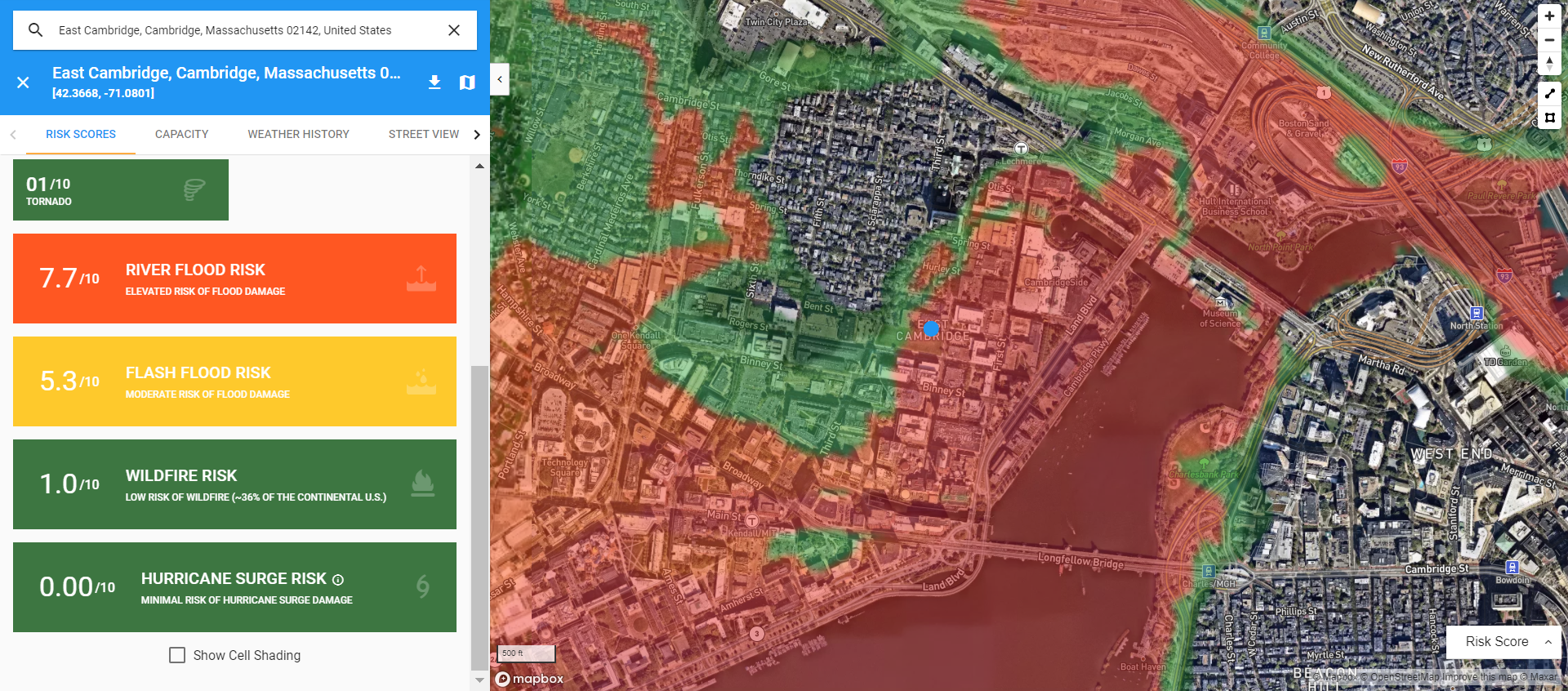

As property values rise and the climate continues to change, flood risks are becoming more significant (and potentially costly) for investors looking to expand and/or reallocate their portfolios. Coastal areas, which include some of the nation’s most expensive real estate, are also at the greatest risk of catastrophic flooding from severe weather and rising sea levels. Flood Risk solutions from Athenium Analytics help property investors and insurers manage three types of flooding (flash, river, and storm surge), calculating risk scores to help users best understand the hyperlocal flood probabilities associated with any parcel or structure.

Underestimating these warning signs could result in huge exposures for property-focused businesses. Is your current property portfolio at risk of severe flooding? In this post, we’ll examine the three different flood types and how GaugeFlood can provide the insights you need to manage current and future investments.

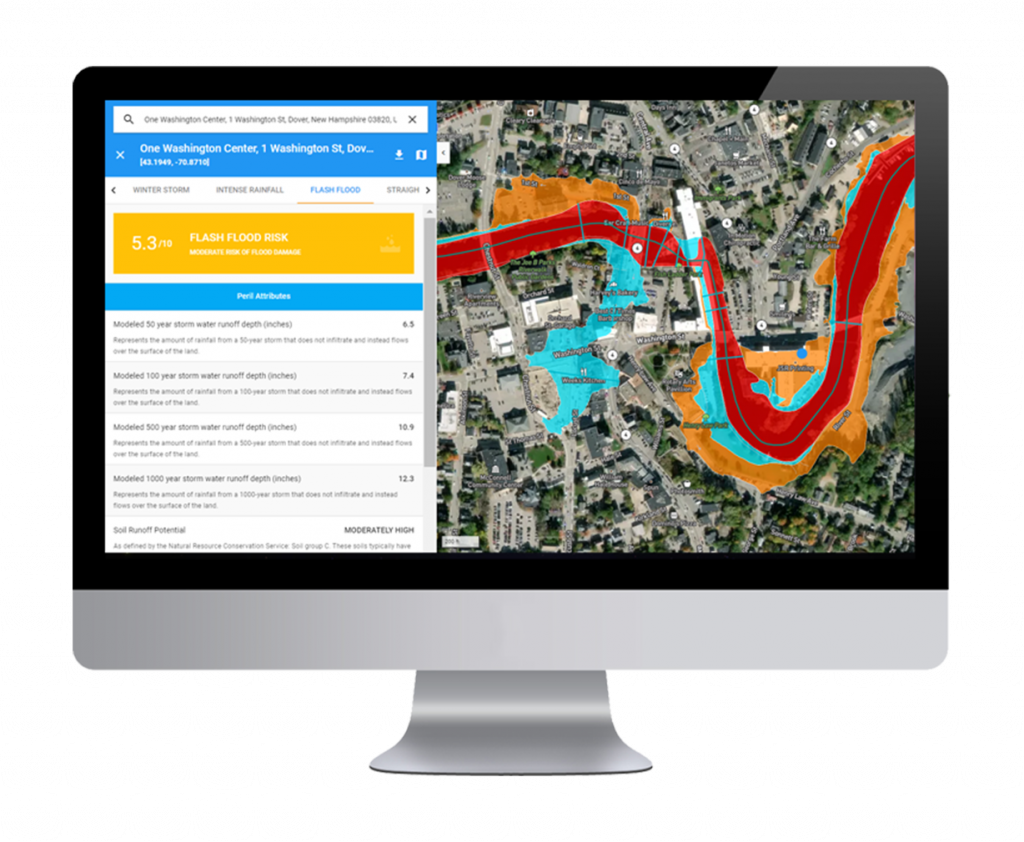

Integrated in a single dashboard, GaugeFlood’s River, Flash, and Storm Surge modules provide modeled flood intelligence for each property across your portfolio. This dashboard delivers a holistic view of flood risk for all current and potential investments within the 48 contiguous states. Discover how you can leverage these hyperlocal flood risk scores to keep your portfolio above water.

Flash floods

Flash flooding is the umbrella term for what occurs when large amounts of water quickly flow through areas of low land. Typically, flash flooding happens so quickly that advanced warning is not possible, making flash flooding the most hazardous weather peril in the U.S. – and modern conditions are doing nothing to curb their frequency:

- During heavy rain, storm drains can become overwhelmed or plugged by debris and flood nearby roads and buildings. Low spots, such as underpasses, underground parking garages, basements, and low water crossings can become death traps.

- The construction of buildings, highways, driveways, and parking lots increases runoff by reducing the amount of rain absorbed by the ground. This runoff increases the flash flood potential.

Investors across the U.S. need flash flood risk scores to protect their portfolios from these severe events. Flash floods present an unpredictable peril that can cause devastation. With GaugeFlood risk scores, you can prepare for the worst using probabilistic scoring based on soil hydrologic attributes, land use and land cover types, rainfall intensity and topography. Where there is water, there is a risk.

River floods

River flooding occurs when large volumes of upstream water surge into water channels, overwhelming their natural pathways and causing them to overtop their banks. The additional fluvial flow impacts the communities established on or near these surrounding floodplains.

The phenomenon of river flooding is not new — in fact, many early civilizations’ origin stories include massive flood events that reshaped environments and cultural beliefs. However, modern conditions are contributing to the increasing prevalence of river floods:

- About 14.6 million homes and other structures across the country currently face a 1% annual risk of flooding, representing about one out of every 10 such real estate parcels nationwide.

- By 2050, 16.2 million properties will be at ‘substantial risk’ of flooding in a given year.

- Intensifying rainfall fueled by climate change has caused nearly $75 billion in flood damage in the U.S. in the past three decades.

Weather and flood data from GaugeFlood helps identify key areas for flood events based on factors such as elevations, distance to water and modeled inundation depth for 50-yr, 100-yr, 500-yr and 1,000-year flood events. Investors are among those who can leverage their decision with such insights.

Storm surge

This GaugeFlood module is based on hurricane storm surge, which is a complex weather phenomenon that occurs when a powerful tropical or post-tropical storm generates intense wave activity and sucks a dome of water into its low-pressure center. When combined, the waves and water dome pound the shoreline, creating areas of severe coastal flooding and large-scale damage.

The cause of increased storm surge impacts is two-fold: Storm intensity and frequency are rising, as is the population of hurricane-affected regions. Consider these modern-day conditions:

- There have been more storms producing concurrent locally extreme storm surge and rainfall along the US East and Gulf Coasts over the last 65 years, with flooding further compounded by local relative sea level rise.

- Nearly four-and-a-half million homes have severe risk of flooding, including many in wealthy areas such as Miami Beach, Florida and Bainbridge Island off the coast of Washington.

The storm surges caused by hurricanes are unavoidable, but unlike flash floods, can be predicted ahead of time. GaugeFlood’s probabilistic modeling and risk scoring analyzes potential storm surges by factoring in the distance property is to coastline, elevation and hurricane frequency/severity probabilities. Investors can now review accurate risk maps with granularity down to the individual property level, providing the most reliable data needed to make more informed investment decisions.

Real estate risk

GaugeFlood, along with the entire line of property risk analytics reports that Athenium Analytics offers, is designed to provide investors with actionable insights for current or future investments. Climate change and an increase in population has left the real estate industry more vulnerable than ever to catastrophic flood losses. While coastal areas continue to see population growth and new construction, many investors, builders and insurers may be overlooking the risks that may impact their investments:

- Homes zoned into a floodplain lose roughly 2 percent of their value, which works out to $10,500 for a $500,000 home. Had buyers factored in the cost of fully insuring the floodplain home against damage, it should have pushed prices down 4.7 percent to 10.6 percent – as much as $53,000 for a $500,000.

- Research shows that between 2005 and 2017, there was a total loss of nearly $16 billion in real estate appreciation due to flooding in coastal states from Maine to Texas.

- According to a Stanford University study, single-family homes in floodplains – almost 4 million U.S. homes – are overvalued by nearly $44 billion collectively, or $11,526 per house on average.

Still, flood risks and property prices have yet to correlate with one another across the broader real estate market. This presents investors with the dilemma of not only having to deal with the flood risks, but also the risks of purchasing properties that are overvalued. GaugeFlood’s risk scoring provides a deeper look into the troubled waters that may arise with every new investment. It’s time to stress test your property portfolio and leverage better risk data to inform future purchasing decisions.

Discover how GaugeFlood can add new clarity and intelligence to your portfolio by requesting a demo today: https://www.athenium.com/products/gauge-flood-risk-scoring/

See how our AI-driven property risk analytics can optimize your portfolio

See GaugeFlood in action: Contact our flood experts today to schedule your free demo