This week, Athenium Analytics released a new risk analytics reporting solution designed to help insurance underwriters, real estate investors and property managers analyze complex risks across their property portfolios.

The new property risk bundle leverages deep insights from IRIS imagery analytics, Gauge risk scores and nationwide property data to deliver detailed risk analytics for each address.

This property risk solution is years in the making – adapting intelligence developed by Athenium for the U.S. military to remotely analyze property risks at hundreds of military installations around the world. With the program’s first phase now complete, this technology is now being released to the private sector for the first time. You can learn more about our large-scale property assessment for the U.S. Air Force here.

Property risk reports

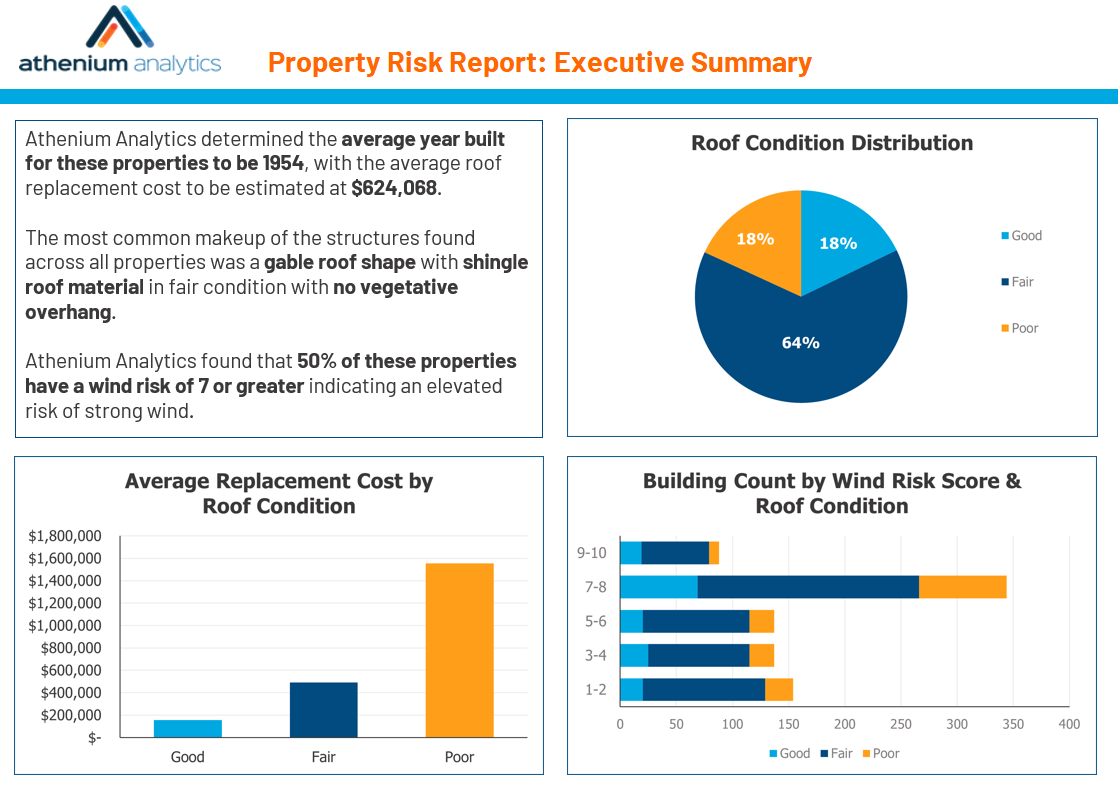

These risk reports include all the core insights users need to analyze and quantify nationwide property risks. They provide data on structural risks, severe weather risks and replacement costs for every structure at a given address. Structural data includes variables like square footage, year built, replacement costs, roof size/materials, roof condition, number of stories and more. And to better understand how local weather trends and history will influence damageability, the reports also contain natural hazard risk scores for each address (across 12 separate perils). These 1-10 risk scores represent the relative severity and frequency of each peril (at each property) and can help owners and insurers understand how hazards like hail, flooding, strong winds and wildfires may affect overall property risks.

Analyze your whole property portfolio with bulk reports

These new property reports also allow insurers to assess property risks across their portfolios with a single report. Rather than overpaying for single-address PDF summaries, users can analyze their entire portfolios within one, comprehensive report. These bulk reports allow underwriters and investors to either assess their entire nationwide portfolios or zero-in on properties in key states or regions. Some of the benefits include:

- Informing annual policy renewals & reinsurance coverage

- Finding & analyzing new potential properties

- Quantifying replacement costs using local data

- Informing discounted cash flow (DCF) models & buy/sell strategies

- Assessing the threat of severe weather across your portfolio

- Modeling local risk appetite and capacity

While low interest rates and inventory continue to drive housing prices up, the growing risk of severe weather and natural catastrophes means that owners, investors and insurers have more to lose than ever before. As climate change continues to put pressure on both commercial and residential properties across the U.S., stakeholders need better property intelligence to inform their portfolios and enable smarter investments moving forward. With deep insights, nationwide coverage and bulk delivery, the new property risk reports from Athenium Analytics can help owners and underwriters do just that.

Learn more about the property risk bundle now.