The client

This carrier, founded in 1914, offers auto, home, business and farm coverage to independent agents in six Midwestern states.

The problem

When storms hit, insurers need accurate and timely post-event data to verify coverage and claims. During a particularly powerful spring storm season, the carrier was impacted by three large catastrophic Midwest storm events over a 17-day period that slowed its settlement process. It struggled with a backlog of claims and needed an easy-to-use solution to help adjusters identify where and when significant weather events took place and evaluate data at specific locations across a large storm path.

Our experience with Dexter has been nothing but beneficial to our claims process. The usability and accessibility of the web-based interface offered minimal training and onboarding interruptions; if you can use a computer, you can use the Dexter dashboard.

The solution

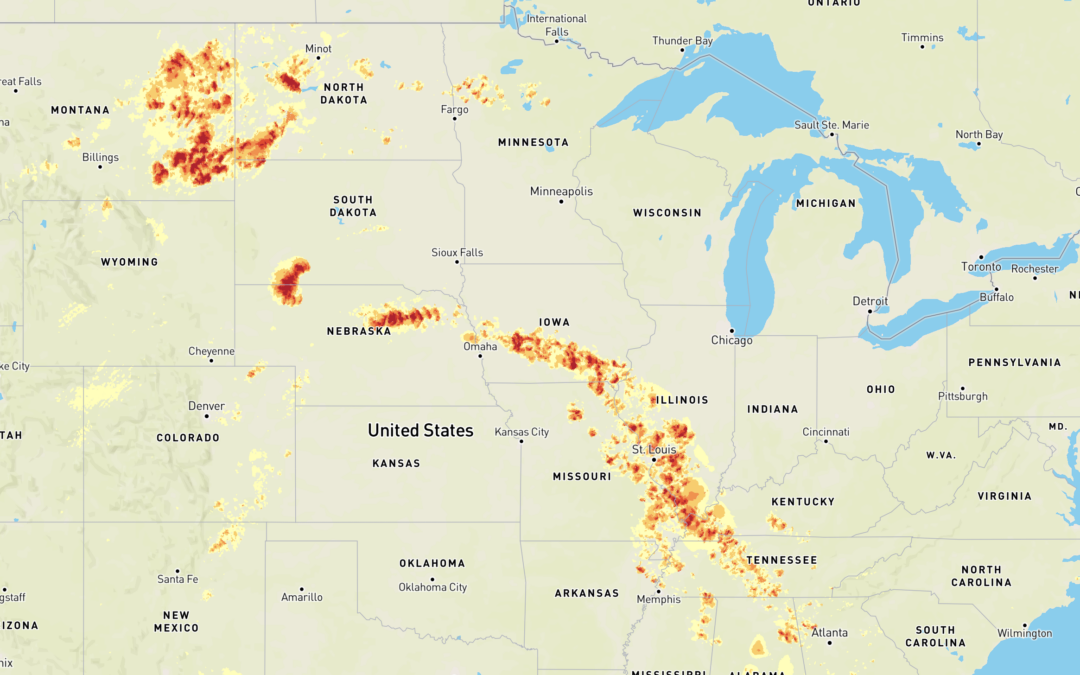

The carrier subscribed to Dexter, the web-based weather forensics dashboard that helps insurers validate the likelihood of damage from weather-related P&C and crop insurance claims. By combining multi-dimensional weather data, hyperlocal (0.3 square mile) resolution and nationwide coverage, Dexter allows claims teams to view accurate storm data and paths within hours of a severe weather event anywhere in the contiguous U.S. Dexter helps visualize a portfolio for exposure management, loss mitigation and historical loss analysis. It also generates exportable PDF weather reports for rainfall accumulation, hail size, temperatures, wind speeds and more.

The results

By introducing Dexter, the carrier improved the accuracy of its claims verification and decision-making processes. The solution enabled the carrier to accurately and immediately allocate the needed adjusting resource to each event, and Dexter’s post-catastrophe analysis allowed the carrier to offer accurate evaluations of historical weather events for any location.