The client

This trusted carrier offers commercial insurance products for businesses in 13 states across the Midwest and is backed by a globally-recognized provider of commercial lines property and casualty insurance and reinsurance.

The problem

Insurers rely on accurate flood risk scores to make the best decisions for their business. This carrier, however, used outdated risk scoring data that led to poor outcomes. It excluded several high-risk properties from flood coverage and required reinsurance on $4 M of its $5 M flood limit. The carrier collected $1.4 M in annual premium and paid $42,000 to reinsurers – that’s 3% of its collected premium out the door.

Using GaugeFlood, we visualized our path to decision making with intelligent data. We even built goodwill with an important partner by offering increased flood data and advanced, targeted analytics.

The solution

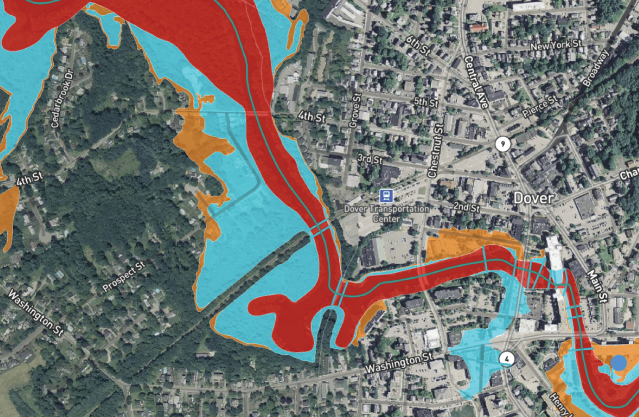

The carrier turned to GaugeFlood, the flood risk assessment solution from Athenium. By entering each insured property into the cloud-based interface, it received actionable risk scores for the three types of flood risk: river, flash and storm surge. GaugeFlood includes convenient overlays of FEMA zones and risks to a 10-meter resolution, which enabled the carrier to clearly visualize and assess flood risks like never before.

The results

Armed with this sophisticated understanding of its flood risk, the insurer confidently revised its exclusion and inclusion lists and eliminated its reinsurance coverage – saving $42,000 practically overnight. Today, its book of business reflects this accuracy, and the carrier can write, renew and reinsure properties with confidence.