Whipping winds, pounding rains, swirling clouds, rising waters – the relentless power of nature when hurricanes hit is equal parts awe-inspiring and terrifying. For insurers, these storms mean an all-hands-on-deck response to help clients prepare for potential damaging impacts, manage post-storm recovery and verify and process claims as efficiently as possible.

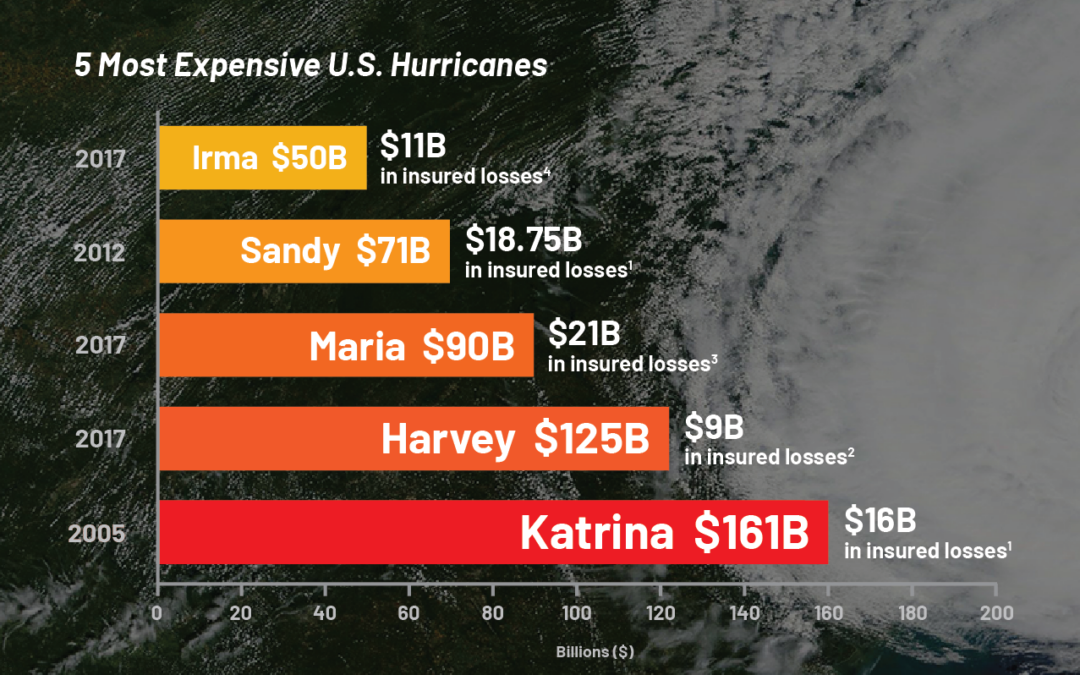

The 5 most expensive U.S. hurricanes

5. Hurricane Irma, Sept. 2017 — $50 B; $11 B in insured losses4

4. Hurricane Sandy, Oct. 2012 — $71 B; $18.75 B in insured losses1

3. Hurricane Maria, Sept. 2017 — $90 B; $21 B in insured losses3

2. Hurricane Harvey, Aug. 2017 — $125 B; $9 B in insured losses2

1. Hurricane Katrina, Aug. 2005 — $161 B; $16 B in insured losses1

Hurricanes are the convergence point for flood, wind, homeowner, automobile and business insurance policies – and Athenium Analytics has pre- and post-storm solutions to help you mitigate damages, verify claims and manage the process more efficiently and with better data resources.

Pre-storm: look to Beacon

BeaconHurricane

Our proprietary 10-day hurricane forecast blends 92 models and ensembles into a single, actionable forecast for increased predictability of path and intensity. You can monitor tropical cyclones 5 days earlier than the NOAA National Hurricane Center and allocate resources earlier.

Post-storm: analyze with Dexter

DexterHurricane

DexterHurricane’s weather forensics dashboard provides post-storm data at a highly granular level to help you assess and manage hurricane claims. Overlay policy exposures, view total insured value in a storm’s radius and analyze high-resolution aerial imagery of properties to quickly assess the impact on your portfolio.

Don’t wait for the next storm. Contact our sales experts today.

Top 5 most expensive U.S. hurricanes

infographic for insurers